Days

Hours

Minutes

Seconds

May 1 2026 - Renters' Right Act Commencement Day

You have 0 days to:

Serve any final Section 21 notices

Stop accepting above-asking rent offers

Prepare for the rental bidding ban

Remove “No DSS” from adverts

Remove “No Children” from listings

Show one clear rent price

Stop using fixed-term agreements

Switch to periodic tenancy templates

Check which tenancies go periodic

Stop taking rent before signing

Take no more than one month’s rent

Move all evictions to Section 8

Train staff on new notice rules

Create Section 13 process flow

Add two months to rent reviews

File court claims for Section 21s

Update landlord move-in grounds

Update landlord selling grounds

Send the RRA Information Sheet

Create written terms where missing

Update How to Rent processes

Review tenant screening questions

Update pet request processes

Stop backdating rent increases

Discuss rent protection backbooks

Act now before it is too late...

Letting agent solutions

Tenant referencing

You don't have to choose between speed and quality with Goodlord.

Place reliable tenants into your landlords’ properties fast and prevent avoidable evictions with the UK’s best tenant referencing company. Get integrated fraud checks, real-time progress reports, and support from a dedicated team of experts.

Outcomes

Accelerate your tenancy process

0 %

References returned within 24 hours

0

seconds

Average customer service response time

0

million

References processed annually by our team

Benefits

Get peace of mind

Cheap referencing providers cut corners. Goodlord's due diligence ensures comprehensive checks happen right at the start of the process, giving peace of mind to you and your landlords. Plus, we give you the support you need, when you need it.

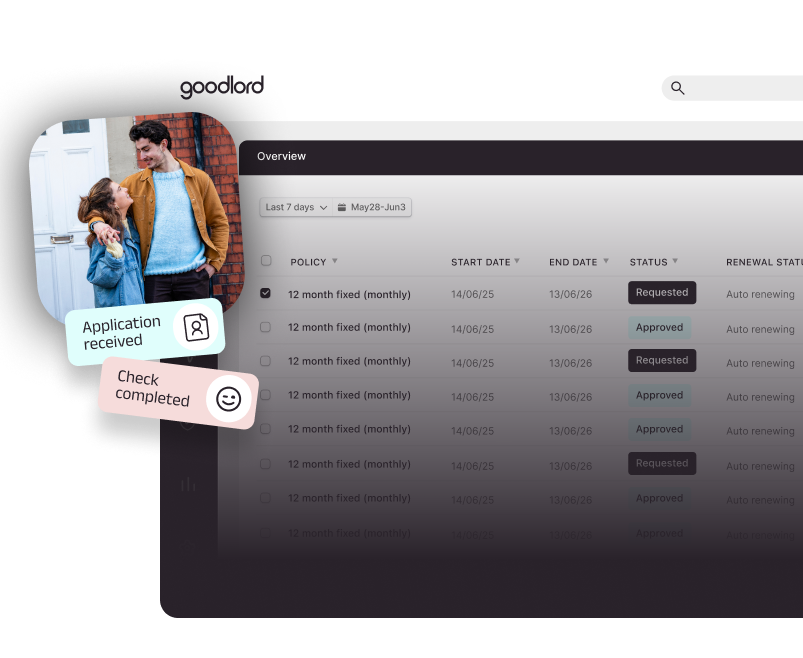

See real-time referencing progress

Your referencing dashboard means no more chasing for updates. See the status of any reference, review flags, and share final reports with your clients.

Get help from our dedicated, in-house referencing squad

You don’t need to wait for hours to speak to a person. Your dedicated referencing squad is on hand to answer all your queries and assist with complex cases.

Slash void periods and creeping costs

Referencing delays lead to void periods, lost rental income, and increased costs. But average 24-hour return rates keep money in your pocket and the tenancy process ticking.

Avoid 15-month+ evictions and huge compliance fines

If tenants secure a property fraudulently, you still need to follow standard eviction processes. Our anti-fraud technology connects you with genuine tenants who have a legal right to rent.

Referencing tiers

Solutions for everyone

| Scroll through our solutions to find your best fit | ||||

|---|---|---|---|---|

| Credit check |

|

|

|

|

| Instant identity document authentication |

|

|

|

|

| Right to Rent documentation collection |

|

|

|

|

| Professional referencing reports |

|

|

|

|

| Share referencing reports with landlords |

|

|

|

|

| Residential checks |

|

|

|

|

| Income checks (Open Banking) |

|

|

|

|

| Income checks (HMRC & payroll providers) |

|

|

||

| Proactive contact from day one |

|

|

||

| Referencing decisions |

|

|

||

| Fully insurable |

|

|

|

Credit check

Instant identity document authentication

Right to Rent documentation collection

Professional referencing reports

Share referencing reports with landlords

Credit check

Instant identity document authentication

Right to Rent documentation collection

Professional referencing reports

Share referencing reports with landlords

Residential checks

Income checks (Open Banking)

Fully insurable

Credit check

Instant identity document authentication

Right to Rent documentation collection

Professional referencing reports

Share referencing reports with landlords

Residential checks

Income checks (Open Banking)

Income checks (HMRC & payroll providers)

Proactive contact from day one

Referencing decisions

Fully insurable

Credit check

Instant identity document authentication

Right to Rent documentation collection

Professional referencing reports

Share referencing reports with landlords

Residential checks

Income checks (Open Banking)

Income checks (HMRC & payroll providers)

Proactive contact from day one

Referencing decisions

Fully insurable

Features

Fraud-resistant technology

We partner with leading providers to deliver the most robust tenant reference checks possible.

Credit checks

We evaluate tenants based on their credit score, outstanding debts, County Court Judgements (CCJs), bankruptcies, past payment behaviour, and more to give you total peace of mind.

Sanctions checks

We automate PEPs and sanctions checks in the referencing flow, allowing you to reduce admin, meet your legal obligations, and avoid potential seven-figure compliance fines.

Direct to payroll checks

We mitigate the risk of payslip fraud by verifying income directly with payroll providers. This service covers over 80% of UK employees, including the NHS, giving you peace of mind.

HMRC verification

We further reduce the risk of payslip fraud via our HMRC integration. This allows us to accurately and holistically verify tenants' income, removing the reliance on documents vulnerable to fraud.

Open Banking

Our Open Banking integration allows us to securely review tenants' financial data, including their employment, pension, and benefits. This instant income verification technique helps to speed up the tenancy process.

Identity Document Validation Technology (IDVT)

Government-approved Identity Document Validation Technology (IDVT) reduces the risk of identity fraud by digitally verifying a tenant's right to rent. It also speeds up the referencing process by removing the need for in-person checks.

FAQs

Frequently Asked Questions

What is tenant referencing?

Tenant referencing is the process of checking the potential suitability of an applicant for a landlord's property. The process involves checking their ID, credit, residential history, and income and affordability.

How long does Goodlord referencing take?

30% of Goodlord’s references are returned instantly, 70% within 24 hours, and 90% within 72 hours.

In the lettings industry, a typical tenant referencing process usually takes two to five working days, and often longer in sectors like retail, banking, or the public sector, where corporate processes can be slow. This timeframe allows for identity verification, credit checks, income verification, and reference checks from previous landlords and employers.

Although completing checks in just two days is ideal, many agents and tenants experience delays. Missing information, slow responses, and communication issues can extend the process - especially when a referencing provider lacks a well-structured system to manage applications efficiently.

What is open banking?

Open Banking enables tenants to securely share their financial data straight from their bank account with referencing providers. With a single, read-only connection to verified account information, providers can quickly assess a tenant’s financial situation. This significantly speeds up the referencing process, often allowing checks to be completed within the same day.

Note: Tenants must have online or mobile banking set up to use Open Banking.

Launched in 2017 by the Competition and Markets Authority (CMA), Open Banking was designed to give consumers more control over their financial data by letting them safely share transaction details with approved third-party providers. These trusted providers can then offer services that save users time and money.

Every third-party provider must pass strict checks and receive authorisation from the Financial Conduct Authority (FCA) (or the equivalent regulator in Europe) before gaining access to data such as bank transactions, credit card activity, and loans.

What is Identity Document Validation Technology (IDVT)?

In the lettings sector, Identity Document Validation Technology (IDVT) is used to digitally check tenants’ identity documents, such as passports and driving licences. It also plays a crucial role in confirming a tenant’s right to rent, addressing the limitations of manual checks. These services are delivered by government-certified Identity Service Providers (IDSPs).

IDVT relies on a combination of advanced digital tools to spot fraud and verify authenticity, including:

- Biometric verification: Uses facial recognition to confirm that a tenant’s appearance matches their official documents.

- Remote right-to-rent checks: Enables tenants to complete the process online, without needing to be physically present.

- Liveness and visual analysis: Confirms that the person being checked is physically present and not using a static image or pre-recorded video.

- Amberhill database check: Matches identity documents against the UK police database to identify those that are lost, stolen, or fraudulent.

- NFC passport chip reading: Instantly validates passport data using a mobile device.

Together, these features make IDVT a faster, more secure, and more accurate way to confirm tenant identities, keeping you compliant while making the process simpler and more convenient for applicants.

What recommendations will I receive when using Goodlord referencing?

Your referencing reports will include one of our referencing recommendations: pass, conditional pass, or fail.

What is the process for student referencing?

You can choose our Essential tier for your student applicants, as this simply does a credit and ID check, allowing you to complete their reference and request a guarantor quickly. Any guarantors will then follow a similar referencing journey to the tenants on the Goodlord platform.

Does Goodlord provide referencing for the NRLA?

Goodlord is the NRLA’s official and exclusive tenant referencing partner. The NRLA became the first organisation to adopt Goodlord’s Public Referencing API, which embeds Goodlord’s industry-leading tenant referencing directly into the NRLA platform.

This integration will power all future referencing services for members, providing quick, reliable tenant checks - without requiring them to use Goodlord’s full software suite.

Testimonials

What our customers say

Kumar Gurung

Letting Agent

“Thanks to Goodlord, I always have complete confidence in my tenant selection process.”

Adrian Ray

Lettings Consultant

“I know for others here time is so tight with doing early starts and late finishes - but it would be even worse, I think, were it not for the Goodlord referencing process, and we continue to get really positive feedback from all of our end users. Be that our landlords and our tenants.”

Daniel Mould

Lettings New Business Partner

“Goodlord's referencing and software let us compete with agents who take two weeks for move-ins. We can do it in 48 hours - no other agency can match that.”

Judy Wadsworth

Job role position

“We would highly recommend Goodlord's PRO reference to other agencies. It's the most efficient referencing service we have used.”